Hi All,

Item Charges Functionality is used in NAV to enter/add charges such as Freight, Custom, Insurance, Clearing, etc. which is pertaining to Items and then link the charges to that Item to arrive at the exact cost of that item.

The item charge can be entered on a separate invoice or in the document where the items that the cost relates to are listed.

It is strongly recommended to pass all the expenses related to Item through Item Charges so that you can finally arrive at Landed Cost of the item being purchased instead of expensing it out using G/L Account directly.

Also, you can use Item Charges for any price difference for purchase or sale transactions.

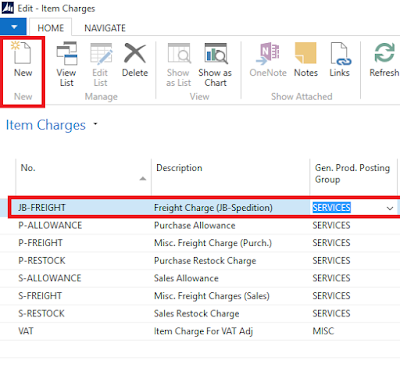

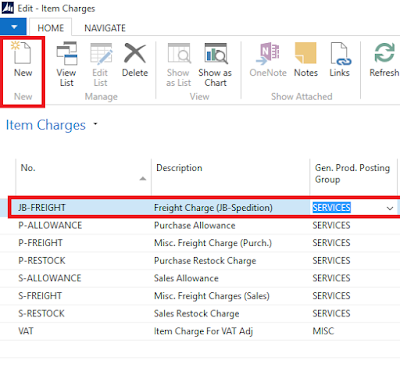

To create a new Item Charge go to Item Charges page as shown below.

Enter the No. and Description and tag the Gen. Prod Posting Group to allow system to pick the expense account for charges.

Here we will create a separate Invoice and load the charge amount to Purchase receipt Lines.

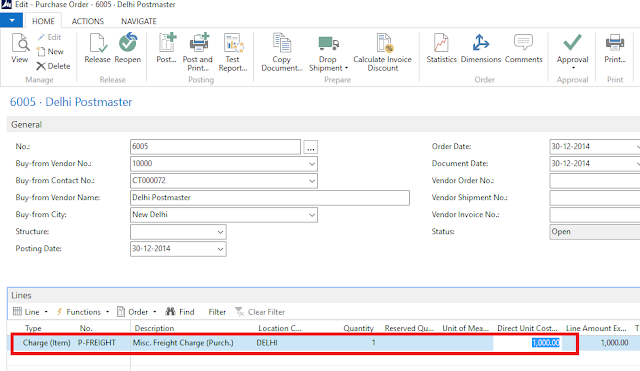

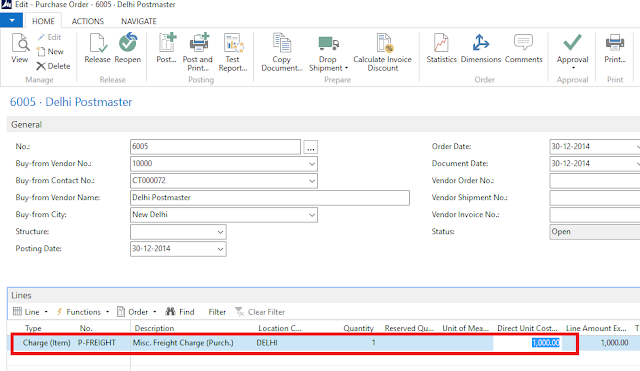

Please create a Purchase Document and select Charge(Item) for Item Charges as shown below.

Enter the Quantity and Amount in Direct Unit Cost.

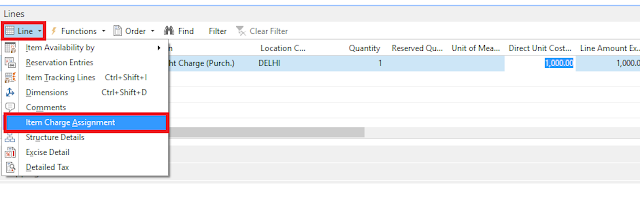

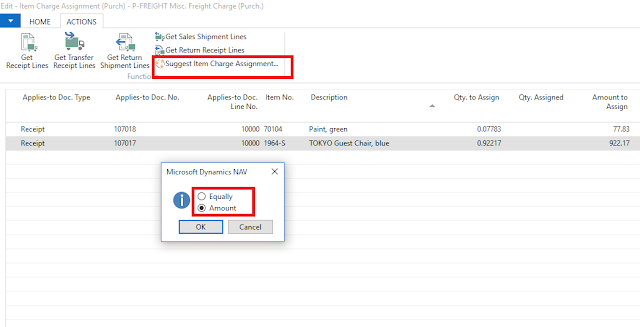

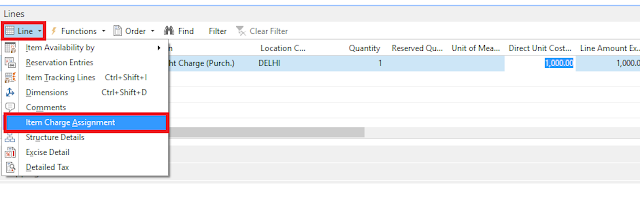

Now Go to Line and select the Item Charge Assignment Option

You can Load Charges on Purchase, Sales, Transfers and Return transactions.

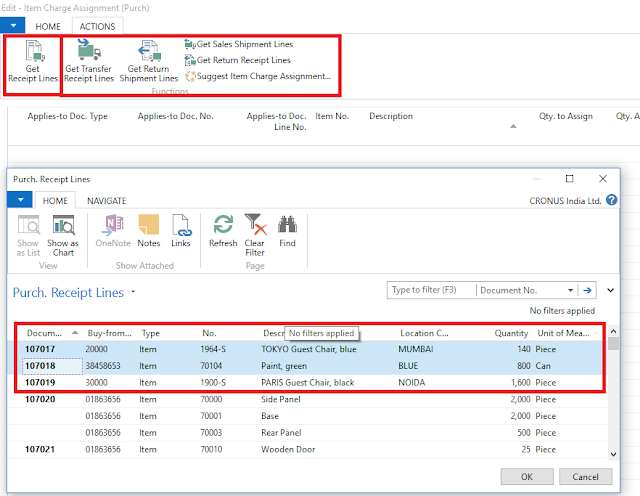

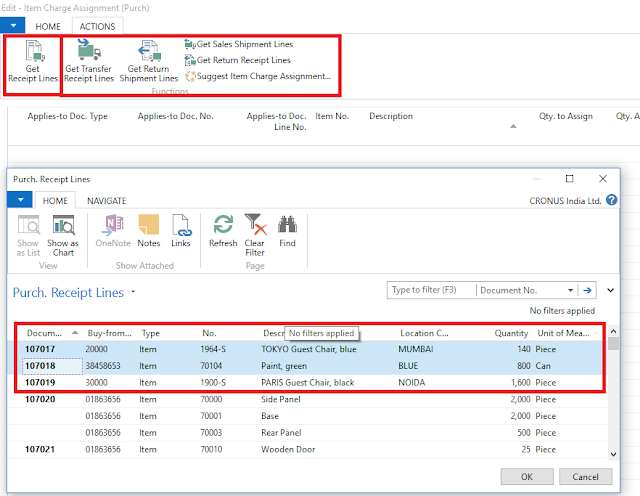

Here we will load on Purchase Receipt Lines. so click on Get Receipt Lines and select the relevant Purchase Receipt Lines. Once selected click on OK.

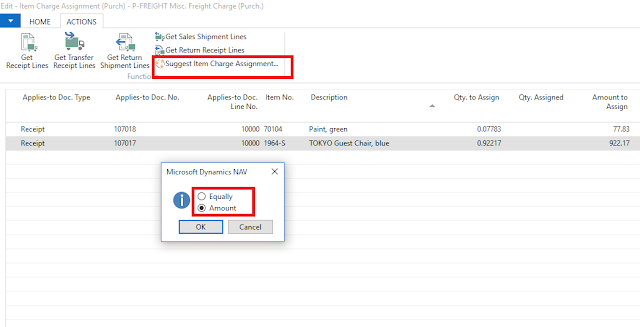

System will give option to split the charge amount Equally or based on Amount. If you have Multiple Items or Multiple Purchase Receipts you may need to split the Charge Amount between those Item Lines.

or

Alternatively you can enter Qty to Assign to split the Amount.

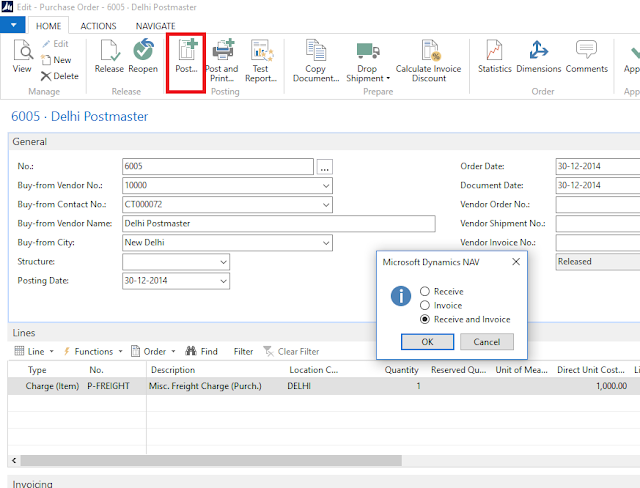

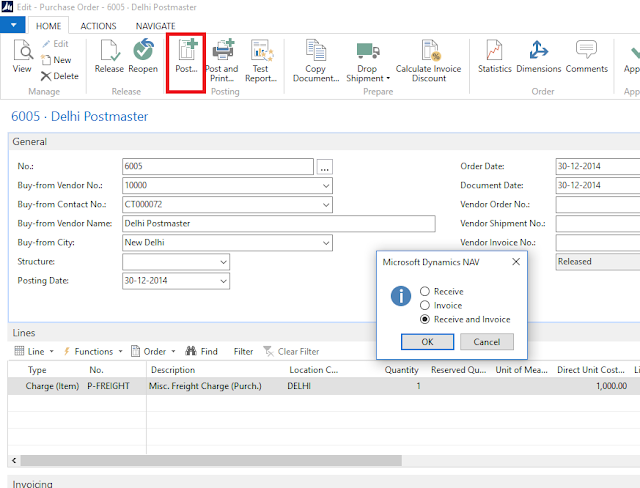

After Assigning the Item Charge we will post the document and see the impact of the Item Charge on the main Item.

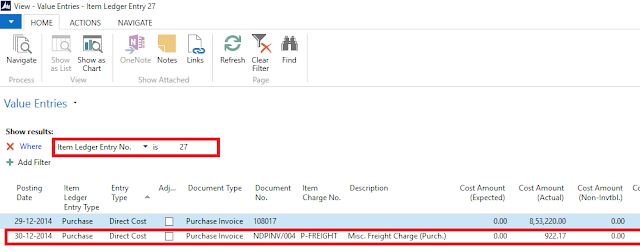

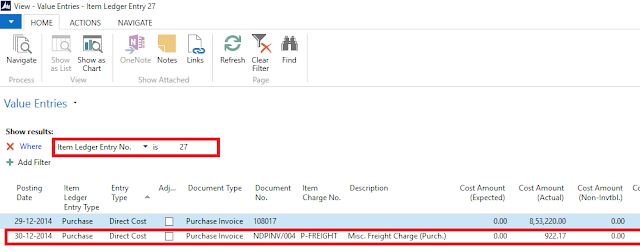

If you Navigate to the Purchase Receipt on which you loaded the Item Charge Amount , you will see system has created one more Value Entry with the Amount you distributed during assigning item charge. So the Cost of the Item for that particular receipt has increased by the Charge Amount.

Thanks & Regards,

Nandesh Gowda

Item Charges Functionality is used in NAV to enter/add charges such as Freight, Custom, Insurance, Clearing, etc. which is pertaining to Items and then link the charges to that Item to arrive at the exact cost of that item.

The item charge can be entered on a separate invoice or in the document where the items that the cost relates to are listed.

It is strongly recommended to pass all the expenses related to Item through Item Charges so that you can finally arrive at Landed Cost of the item being purchased instead of expensing it out using G/L Account directly.

Also, you can use Item Charges for any price difference for purchase or sale transactions.

To create a new Item Charge go to Item Charges page as shown below.

Enter the No. and Description and tag the Gen. Prod Posting Group to allow system to pick the expense account for charges.

Here we will create a separate Invoice and load the charge amount to Purchase receipt Lines.

Please create a Purchase Document and select Charge(Item) for Item Charges as shown below.

Enter the Quantity and Amount in Direct Unit Cost.

Now Go to Line and select the Item Charge Assignment Option

You can Load Charges on Purchase, Sales, Transfers and Return transactions.

Here we will load on Purchase Receipt Lines. so click on Get Receipt Lines and select the relevant Purchase Receipt Lines. Once selected click on OK.

System will give option to split the charge amount Equally or based on Amount. If you have Multiple Items or Multiple Purchase Receipts you may need to split the Charge Amount between those Item Lines.

or

Alternatively you can enter Qty to Assign to split the Amount.

After Assigning the Item Charge we will post the document and see the impact of the Item Charge on the main Item.

If you Navigate to the Purchase Receipt on which you loaded the Item Charge Amount , you will see system has created one more Value Entry with the Amount you distributed during assigning item charge. So the Cost of the Item for that particular receipt has increased by the Charge Amount.

Thanks & Regards,

Nandesh Gowda

No comments:

Post a Comment