Hi All,

You can view and change item application entries that are automatically created between item ledger entries during item transactions.

When you post a transaction where items are moved in or out of inventory, an item application is created between each inventory increase and inventory decrease.

These applications determine the flow of costs from the goods that are received in inventory to the cost of goods going out of inventory.

Because of the way the unit cost is calculated, an incorrect item application could lead to a skewed average cost and a skewed unit cost.

You can undo an application or reapply the item ledger entries. Below scenario's may require you to do so.

- You have forgotten to make a fixed application.

- You have made an incorrect fixed application.

- You have to return an item to which a sale has already been applied.

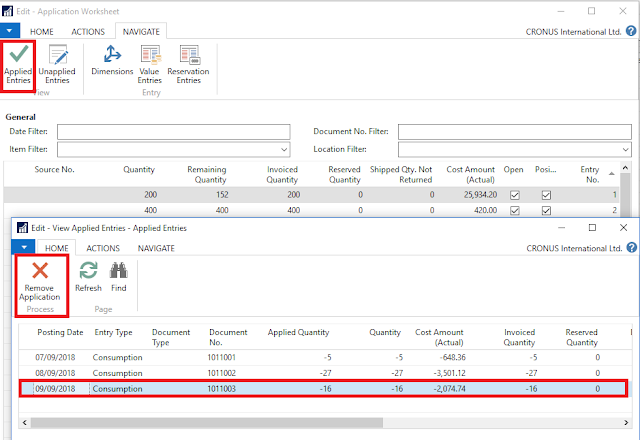

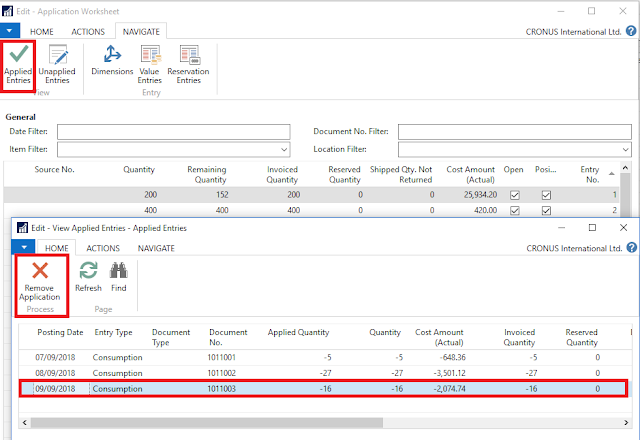

You can view the Applied Entries for an Item Ledger Entry by clicking on the

Application Worksheet--> Applied Entries.

Also you can remove the Application by clicking on the

Remove Application action.

To

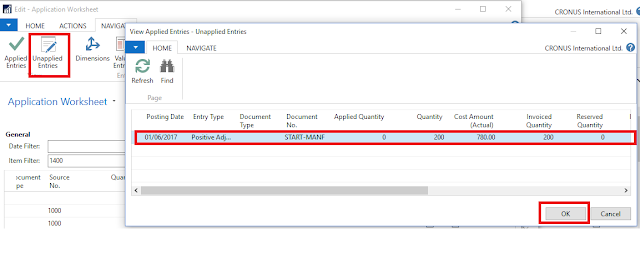

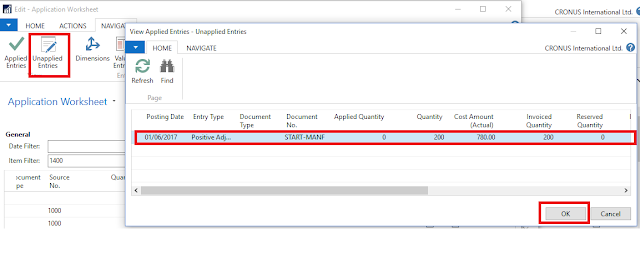

Reapply an item application: Click on

Unapplied Entries and then select the Entry against which to apply and press

OK

If possible, use a document to reapply an item ledger entry. For example, if you must make a purchase return of an item to which a sale has already been applied, you can reapply by creating and posting the purchase return document by using the correct application in the

Appl.-to Item Entry field on the purchase return line.

You can use the

Get Posted Document Lines to Reverse function or the

Copy Document function in the purchase return document to make this easier. When you post the document, the item ledger entry is automatically reapplied.

If you cannot use a document to reapply, such as when you have to correct a fixed application, then use the Application Worksheet window to correct an application.

Warning Warning |

|---|

The following are important considerations to remember when you are working with the application worksheet:

- You should not leave application entries unapplied for long periods of time because other users cannot process the items until you reapply the application entries or close the Application Worksheet window. Users who try to perform actions that involve a manually unapplied application entry receive the following error message:“You cannot perform this action because entries for item XXX are unapplied in the Application Worksheet by user XXX.”

- You should only reapply item ledger entries during nonworking hours to avoid conflicts with other users who are posting transactions with the same items.

- When you close the application worksheet, Microsoft Dynamics NAV performs a check to make sure that all entries are applied. For example, if you remove a quantity application but do not create a new application, and then you close the application worksheet, a new application is created. This helps keep the cost intact. However, if you remove a fixed application, a new fixed application is not automatically created when you close the worksheet. You must do this manually by creating a new application in the worksheet.

- It is possible to remove applications from more than one entry at a time in the application worksheet. However, because applying entries affects the set of entries that are available for application, you cannot create an application for more than one entry at a time.

- The application worksheet cannot make an application in the following situation: If there is not enough quantity on stock to apply, the application worksheet cannot make an application when you are trying to apply an inventory decrease entry without item tracking information to an inventory increase entry with item tracking information.

|

Thanks & Regards,

Nandesh Gowda

Warning

Warning